Note - from June 24th 2009, this blog has migrated from Blogger to a self-hosted version. Click here to go straight there.

- data on new jobless claims was worse-than-expected, with a 15,000 rise in claimants (consensus was for a 6,000 fall);

- real labour compensation falling y/y (-0.4% for non-farm workers, and -1.0% overall);

- productivity revised down m/m (2.5% annualised: consensus was 2.8% and last month was 3.7);

- retailers sales reports were weaker than expected; Wal-Mart grew sales just 0.5% when the market expected 1.5%.

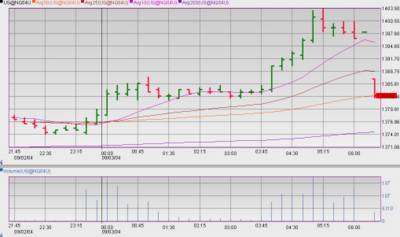

Over at Times Square, the Nasdaq Composite gained 23.02 points (1.24%), to close at 1873.43, and the Nasdaq100 Index tacked on 20.38 points (1.48%), to end at 1398.34 points. At 4 a.m. our time, the Nasdaq100 was up just 7 points. After Intel's news, the Nasdaq100 futures fell back to where they were at 4 a.m. - as the chart below shows.

The broader stock market measures lagged the Dow a little: NYSE Composite Index gained 65.19 points (1.01%), closing at 6535.05, and the broadest measure of US equities, the Wilshire 5000, adding 116.59 points (1.08%), finishing the session at 10865.46

NYSE Volume was well below average, with 1.12 billion shares crossing the tape, while Nasdaq Volume was likewise pretty feeble, with 1.21 billion shares traded. All in all, the late-day surge on pitiful volume is hardly anything to write home about; if anything it is a cause for concern, given that the sole explanation that I have been able to find relies on good news from George W Bush: what on earth do people expect from a campaign speech? The truth?

| Index | Close | Gain(Loss) | % |

| DJIA | 10290.28 | 121.82 | 1.2% |

| S&P500 | 1118.31 | 12.4 | 1.12% |

| Nasdaq Composite | 1873.43 | 23.02 | 1.24% |

| Nasdaq100 | 1398.34 | 20.38 | 1.48% |

| NYSE Composite | 6535.05 | 65.19 | 1.01% |

| Wilshire 5000 | 10865.46 | 116.59 | 1.08% |

| NYSE Volume | 1.12bn | - | - |

| Nasdaq Volume | 1.21bn | - | - |

| US 30-yr yld | 4.99% | 0.05% | 1.03% |

On the NYSE advancing Issues outpaced decliners by 2373 to 915, for a one-day A/D reading of a staggering 1463. Nasdaq gainers beat out decliners by 1974 to 1025.

NYSE advancing volume dominated volume in decliners by 5.5:1, with 931.61 million shares traded in stocks that went up for the session, compared with just 166.15 million in declining issues.

The story was slightly less ludicrous on the Nasdaq: advancing volume exceeded volume in decliners by 483.93 to 149.64.

The NYSE had 124 stocks which posted new 52-week highs, and just 9 hitting new 52-week lows; again the Nasdaq had slightly less stellar numbers, with 47 stocks reaching new 52-week highs, and 29 posting new 52-week lows.

| NYSE | Nasdaq | |

| Advancers | 2373 | 1974 |

| Decliners | 915 | 1025 |

| Advancing Volume (m) | 931.61 | 483.93 |

| Declining Volume (m) | 166.15 | 149.64 |

| New Highs | 124 | 47 |

| New Lows | 9 | 29 |

| Index | Close | Gain(Loss) | % |

| Equity Call Volume | 1.75m | 0.23m | 14.99% |

| Equity Put Volume | 149m | 0.08m | 5.99% |

| CBOE Volatility Index | 14.28 | -0.63 | -4.23% |

| CBOE Nasdaq Market Volatility Index | 21.62 | -1.03 | -4.55% |

Bonds fell at the long end, with the benchmark US 30-year bond yield rising 0.08 basis points to 4.998%. Let's just call it 5% and be done with: that means that you can get 5% - in actual distributions, guaranteed - for 30 years in bonds, versus a little over 2% dividend yield in equities.

Both equities and bonds are priced far too high at the moment, and the best long-term bet is to be short both - but while bonds are likely to decline 10-20% in price (to around 90 for the standard US T-bond futures) in the long run, equities will continue to decline until dividend yields reach 6-8%.

| Index | Close | Gain(Loss) | % |

| UST 2Y (yld) | 2.444 | 0.06 | 2.73% |

| UST 5Y (yld) | 3.384 | 0.09 | 2.89% |

| UST 10Y (yld) | 4.212 | 0.1 | 2.46% |

| UST 30Y (yld) | 4.998 | 0.08 | 1.52% |

- the Derivative King - JPMorganChase gained $0.58 (1.48%) to close at $39.84; and

- Citigroup gained $0.54 (1.16%) to close at $46.99

The Broker-dealer Index gained 1.86 points (1.5%), finishing the session at 125.97; the ticket clippers lined up as follows -

- Merrill Lynch gained $0.49 (0.96%) to close at $51.76

- Morgan Stanley Dean Witter gained $0.90 (1.79%) to close at $51.25

- Goldman Sachs gained $1.87 (2.1%) to close at $91.06

- Lehman Brothers gained $0.92 (1.25%) to close at $74.68

The Philadelphia SOX (Semiconductor) index gained 3.44 points (0.92%), finishing the session at 377.6

- Triquint lost $0.01 (0.26%) to close at $3.90

- Micron Technology gained $0.01 (0.09%) to close at $11.65

- Intel gained $0.20 (0.93%) to close at $21.63

- Altera lost $0.03 (0.16%) to close at $19.06

- JDS Uniphase lost $0.01 (0.32%) to close at $3.12

After the bell, Intel released its mid-quarter update, and sure enough it was a stinker: revenue guided to $8.3-$8.6 billion, below the low end of the range it previously forecast ($8.6-9.2 billion). The midpoint estimate has been reduced by 5%.

Intel also expects gross margin to be 58-60%, which is lower than its previous forecast of 60%. A 5% fall in revenue (using the midpoint estimate) and a 1% fall in gross margin, means a 6.6% drop in gross profit.

At one stage Intel shares (which were up 20c (1%) during the regular session) had fallen to $19.78, but as I write they are back to $20 - still a drop of 9.2% from the close.

Other indices popular with the beta-chasers were up, with the

- Biotech Index gained 7.62 points (1.51%), to 511.2

- the Hi-Tech Index gained 6.91 points (1.63%), closing at 431.76

Gold weakened by $1.70 (0.00%), which contributed to the Gold Bugs Index losing 1.89 points (0.91%) to 205.76. Silver fell by $0.02 to close at $6.79 per ounce. The Gold and Silver Index (XAU) lost 0.83 points (0.87%), finishing the session at 94.51

| Index | Close | Gain(Loss) | % |

| Gold | 407.00 | -1.70 | -0.42% |

| Silver | 6.78 | -0.02 | -0.29% |

| PHLX Gold and Silver Index | 94.51 | -0.83 | -0.87% |

| AMEX Gold BUGS Index | 205.76 | -1.89 | -0.91% |

Oil was firmer, rising by $0.22 per barrel, closing at $44.12 per barrel and lending a bid to the Oil and Gas Index (XOI) which gained 5.89 points (0.91%), finishing the session at 652.54. The Oil service stocks (OSX) Index lost 0.05 points (0.04%), finishing the session at 112.3.

YUKOS released a statement which declared that it would be forced to impose output cuts, referring to a recent court decision (on Tuesday) that froze its bank accounts. It said that the decision "paralyses the production activities of Yukos". Oil spiked to over $45 by mid-session, and then someone stood on its throat real hard. The chart below tells the story:

| Index | Close | Gain(Loss) | % |

| Reuters CRB | 279 | -3.5 | -1.24% |

| Crude Oil Light Sweet | 44.12 | 0.22 | 0.5% |

| AMEX Oil Index | 652.54 | 5.89 | 0.91% |

| Oil Service Index | 112.3 | -0.05 | -0.04% |

The US dollar posted slight gains across the board - the Euro stalled at 1.2200 during the European session last night, and spent most of the US session making lower highs and lower lows. At about 5 a.m. our time it appeared to break up out of its declining channel.

| Index | Close | Gain(Loss) | % |

| US Dollar Index | 89.02 | 0.1 | 0.11% |

| Euro | 1.2172 | -0.002 | -0.16% |

| Japanese Yen | 109.44 | 0.03 | 0.03% |

| Sterling | 1.7906 | -0.0028 | -0.16% |

| Australian Dollar | 0.6973 | -0.005 | -0.71% |

| Swiss Franc | 1.261 | 0.0017 | 0.13% |

European bourses were all positive for the session - and bear in mind that they have not yet factored in the afternoon goosing received by the US markets (but nor have they taken in the Intel update).

France's benchmark CAC-40 Index gained 20.15 points (0.56%), finishing the session at 3633.38; The German DAX-30 Index gained 15.83 points (0.41%), finishing the session at 3833.45; and in the UK, the FTSE-100 Index gained 16.6 points (0.37%), finishing the session at 4518.6.

| Index | Close | Gain(Loss) | % |

| CAC-40 | 3633.38 | 20.15 | 0.56% |

| DAX-30 | 3833.45 | 15.83 | 0.41% |

| FTSE-100 | 4518.6 | 16.6 | 0.37% |